USF Contribution Charge

Note: As of October 2024, USAC no longer sends monthly paper invoices. The monthly USF calculations based on the FCC Form 499-Q are now available in E-File instead of your monthly paper invoice.

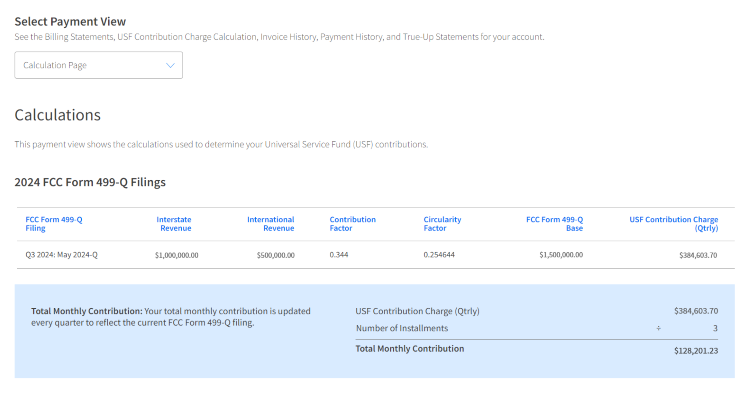

A contributor’s universal service contribution obligation, the quarterly “USF contribution charge,” is calculated in the first month of the quarter from the projected revenue reported on Lines 120B and 120C of the quarterly FCC Form 499-Q filing multiplied by the FCC’s contribution and circularity factors. USAC then divides that quarterly universal service contribution obligation by three to determine the monthly charge.

Exemptions to a monthly universal service contribution obligation include the Limited International Revenue Exemption (LIRE) for predominately international providers and the de minimis exemption for filers with small interstate and international revenues.

View the calculations for your USF contribution charge by signing into E-File, going to the Payments tab, and selecting the “Calculations” view in the Select Payment View dropdown menu.

For all disputes regarding invoicing or late filing/payment fees, visit the Billing Disputes page.

Example of USF Contribution Charges

The formulas to calculate the contribution charge are as follows:

- FCC Form 499-Q Base (or “base”) = Interstate Revenue + International Revenue

- Unadjusted Contribution = Base x Contribution Factor

- USF Contribution Charge = Unadjusted Contribution – (Unadjusted Contribution x Circularity Factor)

In the above example, the base is $1,500,000. Though not shown, the unadjusted contribution is $516,000, meaning that the USF contribution charge is $384,603.70. This total is divided by three to determine the monthly contribution amount.